My latest column: To boost international investor enthusiasm for China, start with Hong Kong tycoons.

When it comes to China, many international investors take their cue from Hong Kong’s business leaders.

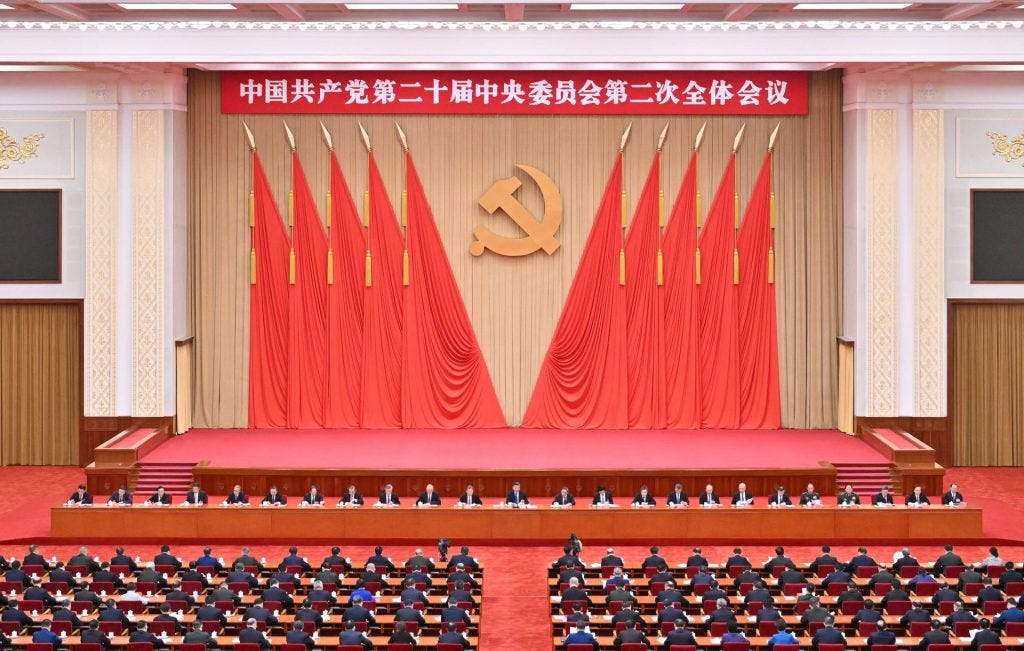

China’s top leaders are set to hold a long-delayed pivotal meeting soon, and are expected to discuss a new growth model and offer a clearer path for the world’s second-largest economy.

But clarity is very hard to detect even with the meeting, widely called a plenum, just a few weeks away. Optimists and pessimists are talking past one another as to what can be expected of the enclave, which could have far-reaching repercussions for the rest of the world.

State media have played up China’s determination to pursue “high-quality development” and “high-level opening up”, President Xi Jinping’s favourite catchphrases, trying to build up expectations of major policy moves at the plenum, set to be held from July 15-18.

In a recent visit to Australia, Premier Li Qiang told local businessmen that China was planning major measures to further comprehensively deepen reforms and steadily expand institutional opening-up, and that China’s investment environment will get better.

But investors and entrepreneurs at home and abroad who have heard those high-sounding slogans too many times over the past four years, but have seen too little action to promote private sector and market forces, have remained downright pessimistic.

A case in point is how China’s leading financial regulators, speaking at the recent Lujiazui Forum, one of the country’s most influential international platforms, tried hard to paint a rosy picture of China’s further reform and opening up, but left investors unimpressed. The mainland and Hong Kong stock markets fell after the forum.

Indeed, how to restore investors’ confidence and get the international investment community to once again accept China’s continued economic rise should become a top priority for China’s leaders at the coming plenum and beyond.

In fact, China has ramped up efforts and rolled out the red carpet for leading foreign investors after it suddenly lifted its self-imposed isolation at the end of 2022, following three years of “zero-Covid” controls . Tesla CEO Elon Musk and Apple CEO Tim Cook were accorded celebrity status during their recent visits.

However, the sentiment of the global investment community has largely remained negative, with some investors labelling China “uninvestable”. In the first five months, inbound foreign direct investment fell by 28.2 per cent year on year, having declined for a 12th straight month.

Obviously, China needs to do much more to improve its appeal to overseas investors to boost growth.

Here is an idea that can go a long way to convincing investors that the next China is still China – that is, to go back to the future by fully mobilising Hong Kong’s business community and leveraging their unique strengths and international influence.

Back in the late 1970s and early 1980s when Deng Xiaoping adopted the open-door policy, Hong Kong businessmen were the first to invest in the mainland, achieving many “firsts”, including the first joint venture and the first five-star hotel. They brought along not only money but also talent, technology and technical know-how.

Moreover, their leading example and success greatly encouraged international investors to choose China as their favourite destination. Hong Kong businessmen have made invaluable contributions to China’s economic rise. By the end of 2022, foreign direct investment flow through Hong Kong into the mainland had reached at an accumulative US$1.57 trillion, accounting for nearly 59 per cent of China’s total.

Even more importantly, Hong Kong business leaders became close advisers to Deng and other top leaders who valued their counsel and wisdom on how to ensure the smooth return of Hong Kong to Chinese sovereignty in 1997, how to further economic reforms at home, and how to broaden China’s appeal to the international community.

Deng cultivated close relationships with a number of leading business leaders and regularly invited them to Beijing for lengthy private meetings. Those business magnates included Yue-Kong Pao, Henry Fok Ying-tung, Li Ka-shing and Louis Cha Leung-yung, the acclaimed novelist and founder of the newspaper Ming Pao. And they were effusively lauded on official media.

Understandably, as the mainland’s economy has risen, Hong Kong’s importance has waned. What has made the matter worse is that the sentiment towards some of those business leaders has turned ominously negative over the past 10 years, partly due to the political wrangling in Hong Kong and partly due to the ideological shift on the mainland. That those magnates no longer enjoy the same access to the leadership in Beijing does not help either.

For instance, Li, the city’s most prominent tycoon and once lauded as a “superman” in China for his vision and acumen, faced withering attacks from the mainland’s social media platforms, particularly during the violent protests engulfing the city in 2019.

As Hong Kong struggles to recover from the three years of Covid-19 restrictions and navigate an increasingly grave geopolitical environment, Ronnie Chan Chi-chung, another prominent tycoon, has publicly stated that the objective of most companies should be to survive, not thrive: “There are simply too many risks, known and unknown, to take an aggressive stance on expansion.”

It is safe to assume that Chan’s views are widely shared by the business community in Hong Kong.

This is something that should demand the fullest attention from China’s leaders. The influence of the likes of Li and Chan is not just local but international. Many international investors would take their cue when it comes to investing in China. If they advise caution, the international business community will be even more cautious.

To turn around the sentiment of the global investment community, China’s leaders should first work harder to reignite the interest and enthusiasm of Hong Kong’s business leaders, like Beijing did 45 years ago.

Exactly, China just needs to decide it’s no longer interested in invading Taiwan, leave them alone to get on with their lives, comply with international law, let their own people have freedoms and open back up to the world. They haven’t done that and probably won’t, so you’re just giving China some ideas to trick the international community into helping them rise economically in the meantime, but the risk of China starting WW3 is still there for investors and only China can back off from that threat.

Li has been rotating his investments out of HK and China for almost a decade. the others can do mostly old fashioned manufacturing and real estate. all sectors currently in decline.

visa-free doesn't mean much since most key executives had an ABTC anyways. Just shaves off a few minutes waiting in line. if those 10mins are going to change investor sentiment and save the economy it sure deserves a 'chapeau'.

the 'uninvestable' label comes mostly from a lack of transparency around economic data since the pandemic, where seemingly any negative trend line just disappears or data collection and interpretation is reeingineered with Chinese characteristics. nobody will invest when risks cannot be managed ie measured. data was always wonky and people knew how to underwrite that. the above prevents even the most astute to thrive. based on the nature of the market there will be people placing bets ans potentially make good bank but that's beyond any HK tycoon's acumen.